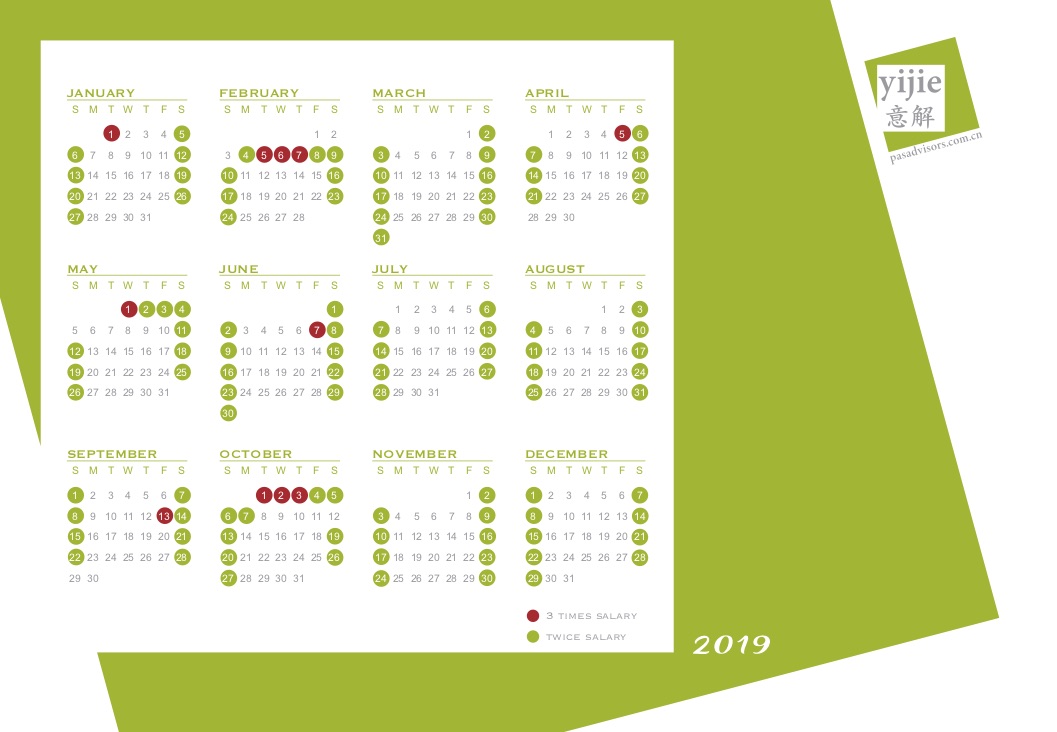

2019 Chinese Holiday Calendar

2019 Chinese Holiday Calendar

NEW FOREIGN INVESTMENT LAW APPROVED

China’s new Foreign Investment Law has been approved by the second session of the 13th National People’s Congress which took place on March 15, 2019. It will go into effect on Jan 1, 2020.

The new legislation is expected to replace three existing laws on foreign direct investment in China that deal with Sino-Foreign equity Joint Ventures, Wholly Foreign-Owned Enterprises and Sino-Foreign Contractual Joint Ventures, since these are considered no longer able to meet the needs of reform and opening up in the new era.

According to the law, foreign investors seeking to set up a business in China will be given national treatment prior to being admitted and will be subject to the foreign investment negative list, which prohibits investment in certain sectors.

The legislation also aims to give protection to the intellectual property rights of foreign-invested enterprises, including a revision of a separate law covering intellectual property protection and the introduction of a mechanism for punitive compensation in cases of intellectual property infringement. It prohibits forced technology transfer and illegal government meddling in foreign business practices.

However, details of operations are still required to be reported to Chinese officials, without legal guarantees that this data will not be passed on to Chinese competitors. Moreover, the law is a set of intentions rather than a specific, enforceable set of rules.

VAT Modifications

On March 5, Chinese Premier Li Keqiang delivered the 2019 Government Work report clarifying the government plans for this year. The following are some hot topics of the report:

Reduction of value-added tax (VAT) rates:

・ The 16% VAT rate, which applies to the manufacturing sector, will be lowered to 13%.

・ The 10% VAT rate, which applies to construction and transport, will be lowered to 9%.

・ The 6% VAT rate, which applies to services, will remain the same.

・ Starting from March 1st, VAT on 21 medicines and 4 active pharmaceutical ingredients for treating rare diseases will be cut from 16% to 3% to help reduce costs and ease financial difficulties for patients.

Reduction of social insurance costs for employers: The pension contribution rate for employers will be lowered to 16%. VAT will be lowered on April 1st and the social security rate will be lowered on May 1st.

Reduction of fees: The price for commercial power usage will be lowered by 10% and the price for commercial internet usage will be lowered by 15%.

Opening Policy:

・ Reduce the negative list of foreign investment.

・ Add a new area to Shanghai’s Pilot Free Trade Zone.

・ Continue to promote Sino-US economic and trade consultations.

Conference on Shanghai’s 100 New Measures to improve foreign investment

On 7th November 2018, the Shanghai Municipal People’s Government represented by the Vice Mayor Mr. Wu Qing held a Conference on overseas investment in Shanghai to introduce the 100 new measures for a more open Shanghai.

On 7th November 2018, the Shanghai Municipal People’s Government represented by the Vice Mayor Mr. Wu Qing held a Conference on overseas investment in Shanghai to introduce the 100 new measures for a more open Shanghai.

The conference was jointly organized with Shanghai’s Municipal Commission of Economy and Informatization, Development and Reform Commission, Commission of Commerce, Finance Service Office, Foreign Affairs Office and Council for the Promotion of International Trade.

Directors of all the industrial parks in the Shanghai area also attended the conference.

Mr. Zhu Min, Vice Chairman of Shanghai Municipal Development and Reform Commission introduced the 100 New Measures for a more open Shanghai, including promotion of banking, securities and insurance sectors; free trade accounts; the easing of limits on service industry access; the opening up of automobile, aircraft and shipbuilding sectors; and the building go a “one-stop portal” for all administrative services.

Sino-Italian Agrifood Forum

In occasione della China International Import Exhibition si è tenuto il primo Sino-Italian Agrifood Forum che ha sviluppato le tematiche legate alla cooperazione bilaterale in aree chiave quali la sicurezza alimentare, l’innovazione, lo sviluppo sostenibile e l’innovazione tecnologica. ICE e Hema, retailer cinese del gruppo Alibaba, hanno firmato un accordo di collaborazione. Hema consentirà ai suoi clienti di accedere più agevolmente ai prodotti italiani provenienti da filiere italiane garantite.

Ms. Shen Li

HEMA, General Manager of Government Affairs

Entry Formalities through Shanghai to Speed up for Qualifying Visitors

Starting from 1st November 2018, Shanghai Entry-Exit Port will start to implement its “144-Hour Visa Exemption Transit Online System”, for foreign visitors who meet the requirements of the 144-Hour Visa Exemption Transit policy. Qualifying visitors can pre-declare China entry information in the system and print an “Entry Pass Card” directly at a self-printing machine after arrival in Shanghai. Immigration clearance time is expected to be reduced to 20 minutes.

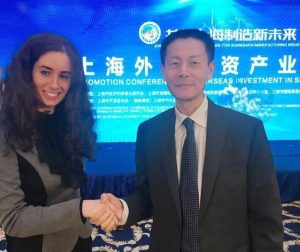

New IIT law

In June 2018 the Standing Committee of the National People’s Congress proposed major amendments to the PRC Individual Income Tax Law (IIT Law). These changes take effect in October 2018, with full implementation of the revised law planned for January 2019. Some changes include:

1) Tax deduction: The statutory deduction (i.e. the first part of the salary that is not subject to IIT) will increase to CNY 5000 (from CNY 3500 for Chinese employees, and CNY 4800 for foreigners).

2) Tax rate: Current and Amended Tax Brackets for IIT on Monthly Taxable Income (after standard deduction and allowable deductions):

More important, is the shuffling/lowering of income tax rates for employees with taxable income of up to CNY 35,000. As an example of the scope of these changes, a Chinese resident national with a taxable income of CNY 40,000 per month would have to pay CNY 8,195 in taxes; but under the amendments his tax burden will fall to CNY 6,090, and that is without even considering the new special deductions.

3) Deductible expenses:

• Education expenses for children;

• Expenses for further self-education;

• Health care costs for serious illness;

• Housing loan interest;

• Housing rent.

4) The amended IIT Law reduces the residency qualification from 1 year to 183 days. This means that any foreign individual who has stayed in China for 183 days or longer in a calendar year will be considered a resident, with income sourced within or outside the country subject to IIT.

5) There will be annual tax settlement also for IIT. A resident tax payer needs to declare and make annual ITT settlement for income sourced within and outside China between March and June next year.

New Profit Tax Rates for Hong Kong

Hong Kong Chief Executive Carrie Lam recently introduced a two-tier profit tax system, with the tax rate on the first two million HKD of profits reduced to 8.25%. Profits above that amount will be taxed at the standard profit tax rate of 16.5%. An additional tax break will be given to companies that spend on R&D. The first HKD 2 million of R&D spending is eligible for a 300% tax deduction, while spending above HKD 2 million is eligible for a 200% tax deduction.

VAT Cuts from May 1st in Manufacturing & Other Sectors

China’s State Council has announced that starting from May 1st the VAT for general taxpayers in manufacturing sectors will be reduced from 17% to 16%, and for general taxpayers in transportation, construction, basic telecommunication services and agricultural products will be reduced from 11% to 10%.

In addition to the VAT rate cuts, China has increased the VAT threshold for small-scale taxpayers. They are now defined as those whose annual sales are less than RMB 5 million. Previously, the small-scale category applied to taxpayers whose sales fell between RMB 500,000 (US$79,490) and RMB 800,000 (US$127,180).

The policies are expected to help reduce companies’ tax burden by RMB 400 billion in 2018. Domestic and foreign-funded enterprises (such as WOFE, JV) will all benefit equally.